Sunday, January 31, 2010

Iran ready to lash out at Israel, warns US official

US National Security Advisor Gen. James Jones is warning that Iran is likely to lash out at Israel via surrogates in response to increasing international pressure over its nuclear program and growing internal frustration with the ruling Islamic regime.

Jones told reporters that what he sees happening is Iran prodding Hizballah and Hamas to escalate hostilities against Israel from Lebanon and Gaza, respectively. Iran provides the bulk of military aid to both terror groups.

Israel has marked heightened tension along its northern border in recent weeks, with both Hizballah and its Syrian allies mobilizing their forces while telling the Arab world that the Jewish state is about to attack Lebanon.

Source: Israel Today

Capital of Pennsylvania Ponders Bankruptcy

Harrisburg City Controller Dan Miller Says Pennsylvania Capital Should Weigh Bankruptcy.

Harrisburg, Pennsylvania, the capital of the sixth-largest U.S. state by population, should skip a $2.2 million debt service payment due Feb. 1 and consider bankruptcy, City Controller Dan Miller said.The first thing Harrisburg should do is fire Management Partners Inc. of Cincinnati, for poor advice. The only recommendation from Management Partners that made any sense was reopening city labor contracts.

Harrisburg faces $68 million in payments this year in connection with a waste-to-energy incinerator and should weigh Chapter 9 protection from creditors or state oversight through a program known as Act 47, Miller said today. Chapter 9 bankruptcy allows municipalities to reorganize rather than liquidate.

The alternatives are to sell assets such as an historic downtown market; an island in the Susquehanna River that includes the city’s minor-league baseball stadium; and the city’s parking, sewer and water systems, according to a preliminary 2010 budget and an emergency financial plan submitted yesterday.

“What I’m suggesting is we stop paying the debt service until we have a plan or we decide which way to go, in bankruptcy or Act 47,” Miller, a former city council member who became controller this month, said in a telephone interview. “I think it could save our assets instead of selling them.”

Management Partners Inc. of Cincinnati, a consulting firm hired to study the city’s finances, recommended selling assets, raising city inspection and recreation fees, and reopening city labor contracts.

Harrisburg owes a total of $68 million in payments it guaranteed on bonds issued by the Harrisburg Authority for the incinerator and on a $35 million working capital loan for the project.

The city skipped more than $3.5 million in debt service and swap payments last year, prompting draws on reserves and back-up payments by Dauphin County, where Harrisburg is located, which has sued the city to recover its payments.

Harrisburg’s debt was downgraded to high-yield, high-risk junk status by Moody’s Investors Service in October. Moody’s lowered the city’s rating to Ba2 from Baa2, the second-lowest investment grade.

Now is not the time to raises taxes or fees. That will only add pressure on businesses and private citizens. Islands can only be sold once, and selling property now would likely do nothing but cause the unions to delay negotiating labor contracts. Moreover, Management Partners Inc. misses making a recommendation to privatize city services.

Declaring bankruptcy is easily the best option. I commend Dan Miller for making it. But all will be wasted if Harrisburg misses the opportunity to renegotiate labor contracts (preferably void them outright), in bankruptcy court.

As soon as a couple major cities declare bankruptcy to end burdensome union contracts and ridiculous pension promises, the stigma will be off and more cities will do it. Indeed, there will be a mad rush to do so, if the first few instances work out as well as I suspect.

Cities and municipalities that get out from the grip of unions will have a huge competitive advantage over everyone else.

Go for it, Harrisburg.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Market Correction Time: Gary Kaltbaum Comments

Gary Kaltbaum is an investment advisor with over 18 years experience, and a Fox News Channel Business Contributor. Gary is the author of The Investors Edge. Mr. Kaltbaum is also the host of the nationally syndicated radio show "Investors Edge" on over 50 radio stations. Gary is also editor and publisher of "Gary Kaltbaum's Trendwatch"... a weekly and monthly technical analysis research report for the institutional investor. If you would like a free trial to Gary's Daily Market Alerts click here or call 888.484.8220 ext. 1.

I am heartened that so many agreed with me about everything I have been saying in this report, on radio and on my tv appearances. This administration and leadership campaigned down the middle and then immediately showed exactly who they are: way way way left, anti-business, pro-government, high tax, class warfareites. If they cannot learn a lesson from losing Ted Kennedy's seat in Massachusetts... then they will never learn.

Americans do not like their intelligence insulted. Unfortunately, or maybe fortunately, many have still not learned as the president just took it up a notch with his "us against them" rhetoric. I have news for this president and anyone who continues this route... IT AIN'T GOING TO WORK.

The market has topped for the near-term and probably the intermediate-term. For me, intermediate means up to a quarter. We'll know in time if it is longer than that. Many are blaming President Obama's numbskullish rhetoric against the banks for causing this. To be clear, that did not help... but the market was topping anyhow. President Obama just gave the market an excuse to move lower immediately. Already, the market may be a little oversold but instead of buying pullbacks, it is time to sell bounces.

I have no idea of the duration of this correction nor price. One can only look for signs that the selling is abating and buyers are getting the upper hand again. My guess is that we will get a lot of up/down action but eventually visit the longer-term 200-day average... which is quite normal for an intermediate correction. Currently, that moving average is about 7-10% below where markets sit right now. I do not believe this is just a few days' phenomenon but of course, we all know that with markets, anything can happen.

The DOW, S&P, NASDAQ, NDX, TRANSPORTS all sliced through the all-important 50-day average though the NASDAQ and NDX are just a smidgen below. In the past three days, over 1700 stocks broke below the 50-day... many which had not breached this area all the way up. Stocks lead indices.

EMERGING MARKETS broke below the 50-day.

Leading foreign countries like BRAZIL and CHINA have rolled over.

FINANCIALS (thank you Barack) have completely broke down. Does this man know these companies have shareholders and employees?

The SOX is almost in "freefall" slicing easily through the 50-day. The SOX has been a leading area since the 90s and always needs to be watched.

Companies are reporting good numbers but still selling off.

I can go on and on but you get the hint. The market is being distributed here... amazingly following the January 4, 2010 template I outlined for you in past reports. In fact, in my last report, I stated the market was still acting fine BUT:

"I can leave it at that but can't. Just recognize the market is 10 months along off the lows without an intermediate correction. Just recognize the last time I saw a market like this, it was January of 04... in where the market started a good correction. Maybe it is meaningless but it is uncanny comparing the bottom in 09 to the bottom in 03... so I watch. Also, bullishness measured by put/calls as well as surveys, is moving into extreme territory. So I watch. But as of this second, I do not have much to complain about."

Going to be an interesting 2010.

Disclaimer: The opinions expressed herein are those of the writer and may not reflect those of Wunderlich Securities, Inc. or any of its affiliates. The information herein has been obtained from sources believed to be reliable, but we can not assure its accuracy or completeness. Neither the information or any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results.

Friday, January 29, 2010

Stock Market Unfinished Business From 2009 For 2010

In March 2009, the Dow bottomed at 6470 and the S&P 500 hit a low of 666. On January 19th we released a report titled, Desperation, which – if this nascent decline continues – will mark the top in the markets, with the Dow at 10,729 and the S&P 500 basically triple-topping on the 11th, 14th, and 19th at 1150. So, in less than one year’s time, the Dow gained 66 percent while the S&P 500 gained 73 percent. And, these numbers are as dubious as they are amazing

Since the 19th, equity markets have dropped sharply and then went sideways this past week. For this reason, I thought we it would be beneficial to examine various events that have taken place since last March, to see what light can be shed on markets for 2010.

On March 27, 2009, in our report, We Are Driven: Taken for the Ride of Our Life, we stated

“Let’s examine the Dow on Wednesday, March 18th, 2009.

No rocket science here. On this day, Bernanke simply announced that the Fed would hand out fistfuls of dollars. A CNN Money article, Fed Buying $300 Billion in Treasuries, states:

‘The Federal Reserve announced Wednesday it would buy $300 billion of long-term Treasuries over the next six months in order to try and get credit flowing more freely again.

The Fed also announced plans to buy an additional $750 billion in mortgage-backed securities; a move designed to lower mortgage rates.’ ”

So, in the early stages of this rally, the Federal Reserve, whose mandate is to provide the US with a “safe, flexible, and stable monetary and financial system,” started swapping out financial institutions’ toxic assets for newly minted U.S. Treasuries and ensured banks that they would provide still more assistance. The same report continues:

“The reason presented for the explosive, 6.8 percent rally three trading days later, on Monday, March 23, 2009, was much the same.

After weeks of handwringing over a plan to purchase toxic assets from banks to help get credit flowing through the financial system again, Geithner and the Treasury presented a $1 trillion bailout program. Geithner’s March 23rd, 2009 article in the Wall Street Journal was titled, My Plan for Bad Bank Assets. In it Geithner states:

‘Today, we are announcing another critical piece of our plan to increase the flow of credit and expand liquidity. Our new Public-Private Investment Program will set up funds to provide a market for the legacy loans and securities that currently burden the financial system.

The Public-Private Investment Program will purchase real estate related loans from banks and securities from the broader markets. Banks will have the ability to sell pools of loans to dedicated funds, and investors will compete to have the ability to participate in those funds and take advantage of the financing provided by the government.

The new Public-Private Investment Program will initially provide financing for $500 billion with the potential to expand up to $1 trillion over time. Over time, by providing a market for these assets that does not now exist, this program will help improve asset values, increase lending capacity by banks, and reduce uncertainty about the scale of losses on bank balance sheets. The ability to sell assets to this fund will make it easier for banks to raise private capital, which will accelerate their ability to replace the capital investments provided by the Treasury.” (Italics Mine)

In case you haven’t been reading on this lately, let me go over the moving parts. The Public-Private Investment Program used to be called the Public-Private Partnership, but “a rose by any name would smell as sweet.” In this “partnership,” the public, that is, the average American citizen, pays 92 percent of the bill to make the banks whole on some bad investments they made. The U.S. “government” loans these investors 85 percent (from my table and yours) and “invests” 7 percent out of all of the “surplus money they have on their balance sheets,” or through the hidden tax of inflation upon its citizens. Of course, private investors put up 8 percent and get to split profits with the government. And for all this, the average person gets to keep the banking system afloat for one more day.’ ”

In that same piece, Joan Veon, founder of the Women’s International Media Group, talked about the history of Public Private Partnerships:

“A Public-Private Partnership is exactly what it says it is. First, it is a partnership that is business arrangement, and it is for profit…Historically, such deals were considered glaring conflicts of interest, and as such, not in the best interest of the people…When you marry government and business, all existing rules of law and government change as the checks and balances of our Constitution no longer pertain…The door is open for anything – politically, socially, and economically. Plunder is tyranny.” (The United Nations Global Straightjacket (1999) Joan Veon, pp83-86)

Then, the markets moved lower in early July. Perhaps people were waking up to the fact that the policies enacted to initiate the “recovery” were the same ones that created the enormous speculative environment that led to the 2000 and 2007 equity bubbles and the 2005 real estate bubble. At that time, we discussed the fact that banks were accumulating massive reserves, a sign that the hundreds of billions they received from the bailouts were not going into the economy, but staying on the balance sheets of these giant banks. In our July 10, 2009 article, Whose Line (of Credit) Is It Anyway, we noted:

“As Paul Kasriel's recent article states, 98 percent of the increased reserves sits on the books of banks:

‘Reserves created by the Fed have increased by a staggering $858 billion in the 12 months ended May. But excess reserves on the books of depository institutions have increased by almost as much, $842 billion. So, in the 12 months ended May, 98% of the increase in reserves created by the Fed has simply ended up as idle reserves on the books of depository institutions.’ ”

And, with the continuing decline in private sector lending, the numbers only got larger as the year progressed. Three weeks ago, in our January 8, 2010 article, Financial Lessons of the Ages, we wrote:

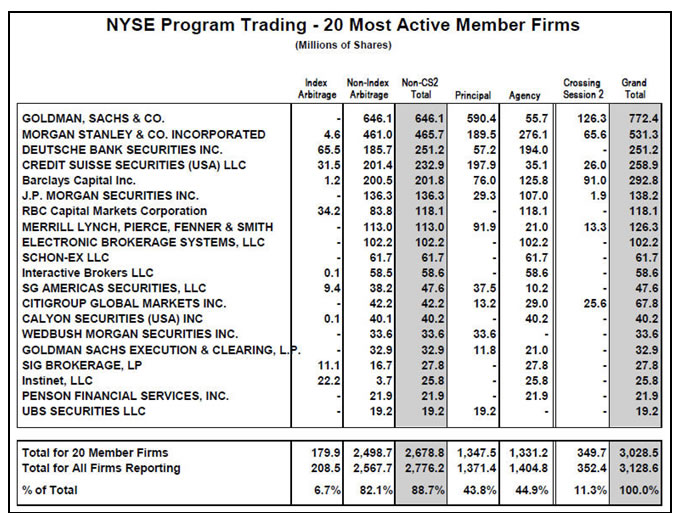

Because of the “serendipitous” murkiness of some of our markets and banking institutions, we cannot prove exactly where and how this money was being used. However, since late May of 2009, professional traders’ commentaries have continued to warn market participants of large swift swings in various markets at “unique” times. Their topics of discussion include the enormous amount of proprietary trading that has been taking place in firms like Goldman Sachs and the power that high speed program trading systems has given to an infinitesimally small number of players in the largest capital markets in the world.

In our July 15, 2009 report, Banksters’ Rigged Roulette Wheels, we illustrated the frequency of high frequency program trading to market prices:

“The truth is, with the advent of high-frequency program trading, unless we are in position when the computer programs change direction, it is nigh unto impossible for investors to win in this brutally rigged game. A tip of the hat to John Mauldin as we open with his assessment of the situation:

‘First, I want to direct the attention of those in the US finance industry to a white paper written by Themis Trading, called “Toxic Equity Trading Order Flow on Wall Street.” Basically, they outline why volume and volatility have jumped so much since 2007; and it’s not due to the credit crisis. They estimate that 70% of the volume in today’s markets is from high-frequency program trading. They outline how large brokers and funds can buy and sell a stock for the same price and still make 0.5 cents. Do that a million times a day and the money adds up. Or maybe do it 8 billion times. It requires powerful computers, complicity of the exchanges (because the exchanges get paid a lot), and highly proximate computer connections. Literally, the need for speed is so important that to play this game you have to have your servers physically at the exchange. Across the river in New Jersey is too slow. Forget Texas or California. This is a game played out in microseconds.

The retail world doesn’t get to play. This is a game only for big boys who can afford to pay for the “arms” needed to fight this war. But the rest of us pay for the game…

Frankly, this is outrageous. The more I read the madder I got. And it is going to get worse as computers get faster and software more intelligent. We need rules to level the playing field. Themis suggests one simple one: just make it a rule that all bids have to be good for at least one second. That would cure a lot of problems. One lousy second! In a world of microseconds, that is an eternity.

Goldman Sachs went after an employee who stole some of their latest and greatest software this last week. The US assistant attorney general said in the courtroom that the software had the potential to manipulate the market. Imagine that. I am shocked. There is gambling going on in the back room? Gee, commissioner, I had no idea.’ ”

In that same piece, we transcribed part of a June 30 2009 Bloomberg interview of Joe Saluzzi, owner of Themis Trading:

“Saluzzi: I am here to talk about the markets, and trading and volume and how fictitious they are…The volume (in shares) that you see in the markets right now, some days as high as 12 billion across all exchanges, is fictitious. It is not real. Sixty to seventy percent of this volume that you’re seeing coming across – it’s volume – but it is done by high frequency traders. These are machines. The biggest machine out there wins the game nowadays. And, these people deal in sub-seconds. Fifty milliseconds is a huge amount of time. If you are anything over that, you are a dinosaur in this business.

So what they do all day long is buy and sell, all day, and try to collect liquidity rebates from the exchanges, which are basically in partnership with them, and they trade for no apparent fundamental reason, and this is my problem…

By the way, principally related program trades is a way to get the markets to go in your direction. What happens is, since we are all electronically linked, the algorithms chase the programs and artificially inflate the prices. But here is the trick. They can run for the trap door tomorrow, and if everybody becomes a seller, they will all just go the other way. They don’t care about the prices any more.

The trick to the market is that the high frequency guy does not add liquidity. He adds volume. There is a big difference between liquidity and volume. Volume is 12 billion shares…who cares? But … if a news event occurs and there is no liquidity there anymore, the trap door opens and there is no one left to buy.

I feel that one day that the door is going to close…everybody is going to be running for the exits…there will be a major move in the markets… and everyone will wonder, ‘What happened? What about that guy on Bloomberg talking about those high frequency guys?’ There is a problem structurally in the equity markets that nobody wants to talk about…there is intervention, manipulation going on… no one has exact proof of what is going on…but it is out there. And the real liquidity has been gone for a while when we got whacked down 40% last month. It never came back. Liquidity never came back.’

With this type of trading advantage, is it any wonder that, as the largest program trader, Goldman Sachs reported their largest quarterly profit in history, at $3.44 billion between April and June of 2009?’ ”

(This chart is from the December 2009 issue of The Investors Mind)

Last, we examine the extreme imbalance in our banking system in our October 9, 2009 report, My Therapy. The Office of the Comptroller of the Currency, charged with “ensuring a safe and sound national banking system for all Americans,” lists various measures in their quarterly derivatives report.

“I turn to page 17 of the Q2 ‘09 Derivatives Report, and see that our financial markets are in ‘good hands’ with Goldman Sachs. It would appear that as long as their high frequency program trading platforms can continue to dominate our capital markets, there really is no need to believe in a downside to equity markets.

But remember, Goldman can find its opportunities on the short side of equity markets. On September 20, 2007, CBS MarketWatch released an article, Goldman Pulls Off Profit Despite Subprime Woes, which is posted on the Weekly page of our site:

‘In a season where brokers have been digesting huge write-downs and trading losses, Goldman has produced a stellar quarter. Profit rose 79% to $2.85 billion, or $6.13 a share -- $1.78 more than the analyst consensus estimate. Goldman’s success was due in a large part to its hedging strategy. The broker absorbed $1.5 billion in credit write-downs, but its mortgage exposure was more than covered by hedging positions. In other words, Goldman made a profit on the mortgage collapse by betting it could happen.’

Frankly, I don’t know of any global financial player trading in our markets that has been able to achieve this feat when looking back over the last 2 years. Think about it: Goldman’s trading profits were seven times that of its nearest competitor, JP Morgan.”

So, we close with three recent charts. Many mainstream media and financial establishments continue to present a positive (if manic) recovery story. I will always continue to look for something deeper than today’s headlines.

(This chart is from our January 19, 2010 Short Report.)

(This chart is from our January 12, 2010 Short Report.)

(Chart from Weekly page of www.bestmindsinc.com, January 27, 2010.)

If the ever- expanding role of the state in our “free” markets in any way lures you into believing that political leaders can give you any insights as to the timing of your investment decisions, you’ll want to consider Bill Moyers’ recent piece, The Financial Lobby Owns Washington:

The nonpartisan Center for Responsive Politics, an indispensable source for information on money’s role in politics, reported in November that “The finance, insurance and real estate sector has given 2.3 billion dollars to candidates, leadership PACs and party committees since 1989.” You heard me right: Billions. A sum that eclipses every other sector — including the defense and health care lobbies.

If you know people who, unlike you, have yet to start learning about the casino we depend on, I strongly encourage you to share this article, and those like it, with them. The months ahead will prove extremely painful to those who buried their heads in the sand.

By Doug Wakefield with Ben Hill

Thursday, January 28, 2010

Rush Linbaugh's Letter to President Obama

The text of Rush Limbaugh's letter to President Obama is below the video if you prefer to read rather than watch. It's no surprise that Rush would criticize the president's State of the Union speech but he does offer several insights into some of the reasons for Obama's behavior and decisions. Rush begins by offering Obama fatherly advice. And that sets the tone of the letter. One of the strongest points is the list of Obama's enemies. You may be surprised when you understand who his enemies are. Anyway, listen to the video or read the text below. I think you'll find it interesting if not hauntingly insightful and prophetic.

And he was, folks! He was mad. Being president is a big job. It's a big responsibility. You wanted the position, Barack. You campaigned for it. You told the public to trust you with it, and they elected you -- and you're now president of the greatest country mankind has ever known, and yet you act like this was all coming to you, like you deserve it, that you're better than the people you are supposed to serve and that you have no tolerance for debate or dissent. That's not the way it works as president, Barack. We have a Constitution, we have checks and balances, we have separation of powers, we have states -- and most of all, we have the people. You don't get to impose your programs and policies on the nation and the people without our consent.

This is a representative republic, not a banana republic, and let me remind you: Karl Marx and Saul Alinsky are not our Founding Fathers. This is a nation built on individuality, built on liberty, free markets, and faith. Yet you, Barack, demand fidelity to a different belief system: A system that crushes individual initiative and free will. The president does not berate Supreme Court justices who are guests of the Congress and who have no ability to respond to your attacks. You've made such a mess of things, Barack, and it's time to stop deluding yourself. It's time to stop blaming others. You are delusional. You are delirious. It's time for you to assume the responsibilities of a president rather than pretending to be one.

You've driven the nation's debt over the edge. It is your responsibility to fix it now. Otherwise, our young people will have no future. You were wrong to grant terrorists constitutional rights. Even the libs in New York don't want the trial there now! You, Mr. President, are endangering the security of this nation. Now fix it! Reverse course, and end the terrorists -- all of them -- back to Guantanamo Bay, where they belong. You are wrong to nationalize one industry after another from automobiles to banks. You are destroying competition and jobs. You need to stop what you were doing before millions of more families go broke from your misguided policies. It's not too late to stop this. I know you're not going to stop it because last night you said you don't quit, and I know what you mean.

| BEGIN TRANSCRIPT |

| RUSH: I penned a message to Obama that I would like to deliver now. Because Mr. Obama, I think it's time we had a heart-to-heart talk. Let me be the father that you never had or never really knew, because I think you need some guidance. It's time to man up. It's time to grow up. That speech last night was an embarrassment. You couldn't focus, you lashed out in all directions, you refused to accept responsibility for your own actions, and you were angry. |

And he was, folks! He was mad. Being president is a big job. It's a big responsibility. You wanted the position, Barack. You campaigned for it. You told the public to trust you with it, and they elected you -- and you're now president of the greatest country mankind has ever known, and yet you act like this was all coming to you, like you deserve it, that you're better than the people you are supposed to serve and that you have no tolerance for debate or dissent. That's not the way it works as president, Barack. We have a Constitution, we have checks and balances, we have separation of powers, we have states -- and most of all, we have the people. You don't get to impose your programs and policies on the nation and the people without our consent.

This is a representative republic, not a banana republic, and let me remind you: Karl Marx and Saul Alinsky are not our Founding Fathers. This is a nation built on individuality, built on liberty, free markets, and faith. Yet you, Barack, demand fidelity to a different belief system: A system that crushes individual initiative and free will. The president does not berate Supreme Court justices who are guests of the Congress and who have no ability to respond to your attacks. You've made such a mess of things, Barack, and it's time to stop deluding yourself. It's time to stop blaming others. You are delusional. You are delirious. It's time for you to assume the responsibilities of a president rather than pretending to be one.

You've driven the nation's debt over the edge. It is your responsibility to fix it now. Otherwise, our young people will have no future. You were wrong to grant terrorists constitutional rights. Even the libs in New York don't want the trial there now! You, Mr. President, are endangering the security of this nation. Now fix it! Reverse course, and end the terrorists -- all of them -- back to Guantanamo Bay, where they belong. You are wrong to nationalize one industry after another from automobiles to banks. You are destroying competition and jobs. You need to stop what you were doing before millions of more families go broke from your misguided policies. It's not too late to stop this. I know you're not going to stop it because last night you said you don't quit, and I know what you mean.

You're gonna keep plugging for the same agenda, which is going to destroy this country even more -- which makes me think, Barack, that's your objective. You know, Barack, unlike most presidents you're dealing with a Congress that has super majorities in both houses, fellow Democrats. It amazes me that with all the talk about your ability to persuade and communicate, that you can't even hold your own party members together anymore. Is that Bush's fault, too? Is it is fault of the banks and the insurance companies and the lobbyists that you can't keep your own Democrat Party unified -- or is it a problem with your leadership, Barack, or lack of leadership? It's the latter, Mr. President. I'll tell you, you are not a leader. You are an agitator and an organizer, and a process guy, but you are not a leader. It is you who are doing something wrong.

The people in Virginia don't like it. The people in New Jersey don't like it. The people in Massachusetts don't like it. The people in Massachusetts and all over the country have the ability to inform themselves outside of your sycophant press corps, and they are doing so. Members of your own governing majority don't like what you are doing. I mean, this calls for some self-reflection and some circumspection. Has it occurred to you, Mr. President, even once that you're not as cool as you think you are? Has it occurred to you that you are screwing up? And if it has, are you happy about that? Has it occurred to you that you have a great deal to learn and that you need to take your own measure, or are you Mr. Perfect? Are you God-sent?

Are you The One that you've been waiting for? See, I have a little concern there may be a psychological issue at play here. I don't say this to demean you, Barack. I say it because I'm concerned. I mean, Tom Daschle was always "concerned" and I like the word. I'm concerned. You seem to have a whole lot of enemies, at least in your own mind. A partial list would include Fox News, insurance companies, banks, oil companies, the "special interests," the Supreme Court, Republicans, talk show hosts, executives, anyone or any business that earns over $250,000 a year, mortgage companies, credit card companies -- and the list goes on and on and on. You have the longest enemies list of anybody I've ever known.

These people are not your enemies, though, Barack. They are Americans. They are part of this country. They are part of what makes the nation work. You are not. You have nothing to do, and have had nothing to do, with this nation's greatness. You can't lay claim to greatness on any scale, not even rhetorical. But you have no direct relationship to the greatness of this country. You are damaging the possibility of further greatness. Nevertheless, like a bully, you continue to threaten all of these people. The Supreme Court, Big Oil, Big Pharmaceutical, Big Retail, talk show hosts, Fox News, the list goes on. You threaten anybody who does not agree with you. You try to intimidate them. You smear them. Your sycophantic media goes right along and carries your water. But this is not what presidents do.

You're supposed to lead not by threatening people but by encouraging them, by embracing them, by thanking them, by inspiring them. Most of all you don't seem to appreciate the magnificence of this nation! I know you don't. The way you've been educated about this country it's painfully obvious. You think this country is guilty, period. Guilty and unjust. You seem to think this country needs to be torn down so you can rebuild it. But you were elected to be president, not some kind of dictator. You must operate within the confines of the Constitution. You are not bigger than the law, and you are not bigger than the people. You were elected to serve the people, not dictate to them. Anyway, I'm sure this little lecture will not do you much good, particularly given the spectacle of your speech last night. You really are full of yourself. But I truly hope that this little talk does do you some good down the way, because something is going to have to change in you or we are doomed for at least the next three years.

END TRANSCRIPT

copyright Clear Channel Communications

Sunday, January 24, 2010

China to USA: Internet controls here to stay - stop making trouble

* Controls include bans on political, ethnic dissent

* Ideological temperature of strains with U.S. rising

* Beijing says Washington fomenting unrest in Iran

By Chris Buckley

BEIJING, Jan 25 (Reuters) - China has every right to punish citizens using the Internet to challenge Communist Party power and ethnic policies, a senior official said on Monday, pressing Beijing's counter-offensive against Google Inc (GOOG.O).

The defence of China's curbs on the Internet came nearly two weeks after the world's biggest search engine provider said it wanted to stop censoring its Chinese Google.cn website and was alarmed by online hacking attacks from within China. [ID:nN12210451]

The dispute has stoked friction between Beijing and Washington, two global economic heavyweights already wrestling with tensions over trade, U.S. weapons sales to Taiwan and human rights.

U.S. Secretary of State Hillary Clinton last week urged China and other authoritarian governments to pull down Internet censorship, drawing a sharp rebuke from Beijing. [ID:nTOE60L070]

In the latest volley, a spokesperson for China's State Council Information Office said the country "bans using the Internet to subvert state power and wreck national unity, to incite ethnic hatred and division, to promote cults and to distribute content that is pornographic, salacious, violent or terrorist".

The comments from the unnamed spokesperson showed scant room for compromise with Google and Washington on censorship policy. They were issued on the central government's website (www.gov.cn).

"China has an ample legal basis for punishing such harmful content, and there is no room for doubting this. This is completely different from so-called restriction of Internet freedom," the spokesperson added.

INTERNET CONTROLS

The State Council Information Office is the cabinet arm of China's propaganda apparatus, which is steered by the Communist Party, and is one of several agencies that shape Internet policy.

The latest comments from China made no direct mention of Google or Clinton.

They appeared intended to shore up the government's case that its Internet controls are for it alone to decide, and that even expression of non-violent views online can amount to a crime in China.

China has prosecuted dissidents and advocates of self-rule in Tibet who have used the Internet to challenge Communist Party policies.

Late last year the country's most prominent dissident, Liu Xiaobo, was jailed for 11 years on charges of "inciting subversion", largely through several essays he published on overseas Internet sites. [ID:nTOE5BO00J]

In recent days, Beijing has raised the pitch of its criticism of U.S. pressure over the Internet.

On Sunday, the People's Daily, the official mouthpiece of the Communist Party, accused the United States of exploiting social media, such as Twitter and Youtube to foment unrest in Iran. [ID:nTOE60K0B6]

China has blocked Youtube since March, the anniversary of uprisings in Tibet, and Twitter since June 2009, just before the 20th anniversary of a crackdown on protestors in and near Tiananmen Square. Facebook has been down since early July.

China also uses a "Great Firewall" of content filtering to deter citizens from viewing banned content on overseas sites. (Editing by Alex Richardson)

Saturday, January 23, 2010

America's Impending Master Class Dictatorship

Thanks to the endless barrage of feel-good propaganda that daily assaults the American mind, best epitomized a few months ago by the “green shoots,” everything’s-coming-up-roses propaganda touted by Federal Reserve Chairman Bernanke, the citizens have no idea how disastrous the country’s fiscal, monetary and economic problems truly are. Nor do they perceive the rapidly increasing risk of a totalitarian nightmare descending upon the American Republic.

One stark and sobering way to frame the crisis is this: if the United States government were to nationalize (in other words, steal) every penny of private wealth accumulated by America’s citizens since the nation’s founding 235 years ago, the government would remain totally bankrupt.

According to the Federal Reserve’s most recent report on wealth, America’s private net worth was $53.4 trillion as of September, 2009. But at the same time, America’s debt and unfunded liabilities totaled at least $120,000,000,000,000.00 ($120 trillion), or 225% of the citizens’ net worth. Even if the government expropriated every dollar of private wealth in the nation, it would still have a deficit of $66,600,000,000,000.00 ($66.6 trillion), equal to $214,286.00 for every man, woman and child in America and roughly 500% of GDP. If the government does not directly seize the nation’s private wealth, then it will require $389,610 from each and every citizen to balance the country’s books. State, county and municipal debts and deficits are additional, already elephantine in many states (e.g., California, Illinois, New Jersey and New York) and growing at an alarming rate nationwide. In addition to the federal government, dozens of states are already bankrupt and sinking deeper into the morass every day.

The government continues to dig a deeper and deeper fiscal grave in which to bury its citizens. This year, the federal deficit will total at least $1,600,000,000,000.00 ($1.6 trillion), which represents overspending of $4,383,561,600.00 ($4.38 billion) per day. (The deficit during October and November, 2009, the first two months of Fiscal Year 2010, totaled $296,700,000,000.00 ($297 billion), or $4,863,934,000.00 ($4.9 billion) per day, a record.) Using the GAAP accounting method (which is what corporations are required to use because it presents a far more accurate and honest picture of a company’s finances than the cash accounting method primarily and misleadingly used by the U.S. government), the nation’s fiscal year 2009 deficit was roughly $9,000,000,000,000.00 ($9 trillion), or $24,700,000,000.00 ($24.7 billion) per day, as calculated by brilliant and well-respected economist John Williams. (www.shadowstats.com) Fiscal Year 2010’s cash- and GAAP-accounting deficits will likely be worse than 2009’s, given government bailout and new program spending that is on steroids and psychotic.

Putting Fiscal Year 2009’s $9,000,000,000,000.00 ($9 trillion) deficit another way, 17% of America’s private wealth, accumulated over a period of 235 years, was wiped out by just one year’s worth of government deficit spending insanity.

Given this, is it any surprise that Treasury Secretary Geithner has announced that the release of the nation’s FY 2009 supplemental GAAP financial statements has been delayed? Remember, this is the same Secretary Geithner who bullied people to cover up the sordid details of the AIG, or more accurately, the taxpayer-funded, multi-billion dollar, Santa Claus bailout and bonus bonanza for Goldman Sachs. Do you really think this government, characterized as it is by fiscal and monetary secrecy, lies, chicanery, cronyism and stonewalling, wants the people to know what is actually happening? Obviously, it does not, so it hides from the public the inexcusable facts.

It is estimated that the top 1% of Americans control roughly 40% of the nation’s wealth. In other words, 3 million people own $21,400,000,000,000.00 ($21.4 trillion) in net private assets, while the other 305 million own the remaining $32,000,000,000,000.00 ($32 trillion). 77,000,000 (77 million) Americans (the lowest 25%) have mean net assets of minus $2,300 ($-2,300.00) per person; they live from paycheck to paycheck, or on public assistance. The lower 50% of Americans own mean net assets of $27,800 each, about enough to purchase a modest car. Obviously, it would be impossible to retire on such an amount without significant government or other assistance. Meanwhile, the richest 10% of Americans possess mean net assets of $3,976,000.00 each, or 143 times those of the bottom 50%; the top 2% control assets worth more than 1,500 times those in the bottom 50%. When you combine these facts with Wall Street’s typical multi-million dollar annual bonuses, you get an idea of wealth inequality in America. Historically, such extreme inequality has been a well-documented breeding ground for totalitarianism.

If the government decides to expropriate (steal) or commandeer (e.g., force into Treasuries) America’s private wealth in order to buy survival time, such a measure will be designed to destroy the common citizens, not the elite. Insiders will be given advance warning about any such plan, and will be able to transfer their money offshore or into financial vehicles immune from harm. Assuming that the elite moves its money to safety, there would then be $120,000,000,000,000.00 ($120 trillion) in American debt and liabilities supported by only $32,000,000,000,000.00 ($32 trillion) in private net worth, for a deficit of $88,000,000,000,000.00 ($88 trillion). In that case, each American would owe $285,714.29 to balance the country’s books. (Remember to multiply this amount by every person in your household, including any infant children.)

If the common people suspect that something diabolical was in the works, a portion of the $32 trillion in non-elite wealth could be evacuated as well prior to a government expropriation and/or currency devaluation, resulting in less money for the government to steal. What these statistics mean is that it is absolutely impossible for the government to fund its debt and deficits, even if it steals all of the nation’s private wealth. Therefore, the government’s only solutions are either formal bankruptcy (outright debt repudiation and the dismantling of bankrupt government programs) or unprecedented American monetary inflation and debt monetization. If the government chooses to inflate its way out of this fiscal catastrophe, the United States dollar will essentially become worthless. You can be absolutely certain that a PhD. in economics, such as Dr. Bernanke, is well aware of these realities, despite what he might say in speeches. For that matter, so are Chinese schoolchildren, who, when patronized by Treasury Secretary Geithner about America’s “strong dollar,” laughed in his face. One day, perhaps America’s school children will receive a real education so that they, too, will know when to laugh at absurd propaganda.

The government has announced that during the fiscal years from 2010 through 2019, it will create an additional $9,000,000,000,000.00 ($9 trillion) in deficits, an amount that is almost certain to be understated by trillions given the country’s current economic trajectory. The government assumes that this vast additional deficit will be funded by others, such as the Chinese, as it is a statistical fact that the United States will be incapable of funding it.

Furthermore, with the budgetary equivalent of a straight face, the Office of Management and Budget reports in its long-term, inter-generational budget projection that the United States government will experience massive, non-stop deficits for the next 70 (SEVENTY) years, requiring the issuance of tens of trillions of dollars of additional debt. The OMB does not project even one year of surplus during the entire seventy year budget period.

These deficits and debts are now so gargantuan that they have become surreal abstractions impossible even for sophisticated financiers to begin to comprehend. The common citizen has absolutely no idea what these numbers mean, or imply for his or her future. The people have been deluded into thinking that America’s arrogant, egomaniacal, always-wrong-but-never-in-doubt fiscal witch doctors and charlatans, including Greenspan, Rubin, Summers, Geithner and Ponce de Bernanke, have discovered a Monetary Fountain of Youth that endlessly spits up free money from the center of earth, in a geyser of good will toward the United States. Unfortunately, this delusion is false: there is no Monetary Fountain of Youth, and contrary to the apparent beliefs of the self-deified man-gods in Washington, D.C., the debt and deficits are real, completely out of control, and 100% guaranteed to create catastrophic consequences for the nation and its people.

When government “representatives” deliberately sell into slavery the citizens of a so-called free Republic, they have committed treason against those people. This is exactly what has happened in the United States: the citizens have been sold into debt slavery that they and their descendants can never escape, because the debts piled onto their backs can never, ever be paid. Despite expensive and sophisticated brainwashing campaigns emanating from Washington, claiming that America can “grow” out of its deficits and debt, it is arithmetically impossible for the country to do so. The government’s statements that it can dig the nation out of its fiscal hole by digging an even deeper chasm have become parodies and perversions of even totally discredited and morally disgusting Keynesianism.

The people no longer have elected representatives; they have elected traitors.

The enslavement of the American people has been orchestrated by a pernicious Master Class that has taken the United States by the throat. This Master Class is now choking the nation to death as it accelerates its master plan to plunder the people’s dwindling remaining assets. The Master Class comprises politicians, the Wall Street money elite, the Federal Reserve, high-end government (including military) officials, government lobbyists and their paymasters, military suppliers and media oligarchs. The interests and mindset of the Master Class are so totally divorced from those of the average American citizen that it is utterly tone deaf and blind to the justifiable rage sweeping the nation. Its guiding ethics of greed, plunder, power, control and violence are so alien to mainstream American culture and thought that the Master Class might as well be an enemy invader from Mars. But the Master Class here, it is real and it is laying waste to America. To the members of the Master Class, the people are not fellow-citizens; they are instruments of labor, servitude and profit. At first, the Master Class viewed the citizens as serfs; now that they have raped and destroyed the national economy, while in the process amassing unprecedented wealth and power for themselves, they see the people as nothing more than slaves.

America’s public finances are now so completely dysfunctional and chaotic that something far worse than debt enslavement and monetary implosion, terrible curses unto themselves, looms on the horizon: namely, a Master Class-sponsored American dictatorship.

Throughout history, the type of situation in which America now finds itself has been a fertility factory for tyranny. The odds of an outright overthrow of the people by the Washington and Wall Street Axis, or more broadly, the Master Class are increasing dramatically. The fact that so few people believe an American dictatorship is possible is exactly why it is becoming likely.

Dictatorships have blighted history and ruined lives since the beginning of civilization. In recent times alone, tyrants such as Hitler, Stalin, Lenin, Ceausescu, Amin, Hussein, Mussolini, Tojo, Kim, Pinochet, Milosevic, Tito, Batista, Peron, Pol Pot, Mugabe, Marcos, Somoza, Mengistu, Bokassa, Sese Seko, Franco, Ho Chi Minh, Mao, and Castro have power-sprayed blood onto the screen of time and ravaged mankind with murder, torture and human oppression. A full catalog of history’s tyrants would require a book of hundreds of pages. In the past 100 years alone, over 200 million human beings have been annihilated by wars, ethnic cleansings and government assassinations. Just when we think that civilization has been able to rise above tyranny’s inhumanity and disgrace, a new dictator appears on the scene to start the process all over again. Every time this happens, fear and submission paralyze the vast majority of the affected masses, leading them to “follow orders” and lick autocracy’s blood-stained boots.

History has proven to tyrants that oppression works. In fact, it is easy to control a populace, once you control the money, markets, military (including police), media and minions (the recipients of welfare, social security, free health care, government jobs and the like, who are dependent upon the state and likely to be compliant). This is exactly where the United States is today.

Recent American events paint an ominous picture of a Master Class that is now in total control.

When 90% of the American people vehemently rejected the $700,000,000,000.00 ($700 billion) TARP bailout plan, the Master Class put it on a fast track and approved it anyway.

When a clear majority of the American people said no to a government takeover of Chrysler and GM, the Master Class poured billions of taxpayer dollars into those corporate sinkholes and took them over anyway.

When the people said no to multi-trillion dollar crony bailouts for the bankers and insurers whose corruption had caused global financial mayhem, the government pledged to those elite insiders more than $13,000,000,000,000.00 ($13 trillion) of the people’s money anyway.

When the people expressed astonishment and anger that Wall Street planned to pay itself record 2009 bonuses, in the midst of America’s worst-ever fiscal and financial crisis caused by them, Wall Street stuffed its pockets with taxpayer-supported bonus money anyway.

When the people said no to a proposed $40,000,000,000.00 ($40 billion) bailout of AIG and its elite trading partners such as Goldman Sachs (an amount that subsequently exploded to $180,000,000,000.00+ ($180+ billion)), the Master Class went underground, covertly misappropriated taxpayer money and made the payoffs anyway.

When Fannie Mae and Freddie Mac were nationalized at enormous taxpayer expense, the government approved $6,000,000.00 individual pay packages in 2009 (150 times the average American wage) for the CEOs of both failed companies anyway.

When a clear majority of the people said no to nationalized health care, even after being bombarded by a multi-million dollar, lie-drenched propaganda campaign designed to bamboozle them, the House and Senate passed nationalized health care bills anyway.

When more than seven million American workers lost their jobs and were subsisting on unemployment benefits and food stamps, federal government employees, who now earn DOUBLE what private sector workers earn, were given another round of pay and benefits increases anyway.

When private sector workers’ 401Ks and IRA retirement plans plummeted in value due to economic collapse and endemic Wall Street-orchestrated market corruption (including systemic front running, flash trading, naked short selling and other manipulations), government “defined benefit,” lifetime-cost-of-living-adjusted pension plans, despite already being underfunded by $2,000,000,000,000.00 ($2 trillion), were made richer than ever anyway.

The long, shameful litany of events signaling the total divorce between the Master Class and the people of the United States doesn’t stop there. It goes on and on.

The message from the American Master Class to the American people is simple and clear:

We Defy You.

Governments that openly defy the people are either already totalitarian or in the process of becoming so. Monetarily, the United States clearly functions as a totalitarian dictatorship already, with a Federal Reserve that operates in secrecy, creates limitless amounts of debt and currency at will, and showers trillions of dollars upon favored Master Class insiders with zero transparency or accountability whatsoever. The Federal Reserve is so shameless about its dictatorial powers that it flatly refuses to provide details about multi-trillion dollar bailouts and rescues of privileged elites, in open defiance of Congress and the people. The fact that they get away with these blatant acts of defiance demonstrates the true extent of the Master Class chokehold on America.

If the Master Class were a benign despot and if its policies and programs actually worked, that would be one thing. But that is not the case. Rather, its programs are in a complete shambles.

Every single government entitlement program in the United States is bankrupt. This includes Social Security ($17,500,000,000,000.00 underfunded; $17.5 trillion); Medicare Part A ($36,700,000,000,000.00 underfunded; $36.7 trillion); Medicare Part B ($37,000,000,000,000.00 underfunded; $37 trillion); Medicare Part D ($15,600,000,000,000 underfunded; $15.6 trillion), Government and military pensions ($2,000,000,000,000 underfunded; $2 trillion), Food Stamps (current underfunding difficult to measure because the number of recipients is exploding; hundreds of billions underfunded versus original projections, minimum); and the list goes on. The above underfunding amounts are NET of projected tax receipts over the next 50 years. But the current recession has invalidated virtually all long-term budget and tax receipt assumptions, meaning that the true underfunded amounts are now greater than current, already mind-boggling estimates.

While the above statistics are terrifying enough to any citizen with a functioning brain, what is Twilight Zone-eerie and a far more serious cause for alarm is the casual indifference with which the Master Class is now making the country’s dire and irreparable fiscal circumstances even worse.

The nationalized health care program will cost at least $1 trillion over the next ten years, and most likely multiples of that. It is being crammed down America’s throat by a bankrupt government that does not have the money today and will not have the money tomorrow to pay for it. Worse is the fact that the same government that has bankrupted each and every existing social program now intends to directly or indirectly control the health care of all citizens. Based on the government’s existing track record and the health care program’s enormous complexity, invasiveness and cost, the probability that it will become a national fiscal and humanitarian catastrophe is roughly 100%.

“Cap and Trade” is a multi-trillion dollar tax scam being foisted onto the American public without a legitimate debate or popular referendum. You might be surprised to learn that “Climate Revenues” are already included in the federal budget, starting with $79,000,000,000.00 ($79 billion) in fiscal year 2012, which begins only 20 months from now. During fiscal years 2012 through 2019, the government expects to collect $646,000,000,000.00 ($646 billion) in “Climate Revenues,” a completely new tax category. Have any of your elected traitors told you that they have enacted $646,000,000,000.00 ($646 billion) in “Climate” taxes beginning twenty months from now and continuing forever? These “Climate Revenues” are based on junk science, lies and hysteria, and have been pimped by greed-diseased parasites who seek to make billions from operating and manipulating the Cap and Trade “marketplace.” Favored elitists such as Hank Paulson, Al Gore, General Electric and Goldman Sachs, among others, have positioned themselves to profit from the nation’s upcoming Cap and Trade tax misery and economic debilitation.

The reality is that the giant Ponzi scheme called the United States of America is running out of money. In any Ponzi scheme, money must constantly be poured into the top of the funnel in order to pay the redeemers at the bottom. As the number of redeemers has grown, tax receipts have fallen far short of covering their withdrawals, a problem that has now become an outright government funding emergency further aggravated by the fiscal, financial and economic crises.

If the Washington and Wall Street Axis were not legally able to create and distribute counterfeit American money, the Ponzi scheme would have collapsed already. Trillions of new, out-of-thin-air, printing-press and electronic “dollars” have bought the Axis additional time, but new sources of revenue must immediately be found to keep the scam alive. Congress is fully aware of this reality. Outright tax increases would be bad politics during a recession that is morphing into a depression, and also bad for 2010 re-election campaigns, so they cannot be implemented. Therefore, Congress continues to advance the health care and Cap and Trade agendas, which are nothing but taxation Trojan Horses festooned in righteousness and sanctimony, despite overwhelming popular opposition.

If the nationalized health care program is passed, revenues and fees will kick in immediately in 2010, whereas costs will not begin to accrue until 2012 and later. The government plans to spend the revenues immediately to forestall a total fiscal collapse. Nationalized health care has absolutely nothing to do with health care; it has to do with creating an immediate revenue stream to help fix the current government funding crisis. Similarly, Cap and Trade has nothing to do with fixing the environment. It, too, is nothing more than a massive tax increase similarly designed to address the government’s epic funding shortfall, with thick slices of pork thrown in for privileged insiders and deceitful propagandists like bloated “Father of the Internet” and now “Savior of the World” Al Gore.

The last thing the Master Class wants is for the people to understand the disastrous state of the nation’s finances. Master Class brainwashing tells the people that it is “negative” and “pessimistic” to look at the facts, despite the fact that psychological health is characterized by the ability to identify and deal with reality. The Master Class wants the people to put on Bozo the Clown happy faces and let sugar plums and green shoots dance in their brains as they write one check after another to pay for Cap and Trade, nationalized health care, and a mind-numbing assortment of other taxes and fees.

On Sunday night, November 30, 2009, North Korea’s dictator Kim Jong Il (a name that says it all, even better than Made-off’s), an international poster child of Master Class psychological illness, devalued his country’s currency by 99%. This vicious tyrant, who has given birth to a national hell on earth, is chauffeured in Mercedes Benz limousines, drinks the finest imported whiskies and dines in imperial dignity on foods prepared by personal chefs while his citizens starve to death on the streets or, at best, eke out a subsistence living. Kim became paranoid that the people were actually figuring out how to improve their pitiful, impoverished lives in tiny ways, so he decided to wipe them out. The people were given one week to exchange their money at a rate of 100 old Won for 1 new Won. Any lifetime family savings in excess of roughly $700.00 were simply confiscated by the North Korean government. To keep the people in line, the military and police were put on high alert, fully prepared to kill or arrest any protesters.

On January 9, 2010, Venezuela’s strong man Hugo Chavez devalued his country’s currency by 50%, overnight and without warning, causing immediate inflation, shortages of food and supplies, and general financial chaos throughout the nation.

While you might be shaking your head in pity over the plight of the citizens of North Korea and Venezuela, ask yourself this: could this not happen in the United States?

On April 5, 1933, President Franklin D. Roosevelt, an Obama hero, outlawed gold ownership overnight by signing Executive Order 6102, which gave the people three and one-half weeks to surrender all privately-owned bullion to the government for a price of $20.67 per ounce. On January 30, 1934, nine months after collecting the people’s gold, Roosevelt devalued the dollar 69% overnight, by raising the gold price from $20.67 to $35.00 per ounce.

Since its founding in 1913, the Federal Reserve has devalued the dollar by 98+% thanks to endless money printing and debt creation, a corrosive and impoverishing process that is now accelerating. In the past year, the Fed has engineered $20+ trillion in bailouts, subsidies and guarantees for well-connected and lucky scavengers and opportunists, an amount equal to roughly 40% of the total private wealth created in this country since its inception. All because a few elitist government man-gods with an almost perfect record of error and failure have deemed in their imperial wisdom that it shall be so. The citizens, whose hard-earned wealth is being systematically destroyed by this continual, government-decreed monetary debasement were never invited to the debate or given a say, which is par for the course for dictatorships. This massive de facto devaluation now hangs over the people’s wealth like a great monetary sword of Damocles.

Conceptually, whether it is a 50% overnight devaluation in Venezuela, a 69% overnight devaluation in the United States, a 98% devaluation in America over time, or a 99% overnight devaluation in North Korea, what is the difference? The fact is: there is no difference; monetary debasements are all the same. In each and every case, the people’s wealth is stolen via government edict, while the people stand by helplessly and in shock.

So one must ask: For whom does the bell toll? A foreign “them,” or a domestic us? Who is to say that you will not be told tomorrow morning that, effective immediately, in accordance with some perversely named mandate such as the “American Monetary Security, Wealth Preservation and Terrorism Prevention Act,” enacted by emergency for “the safety of the nation and the financial well being of the citizens,” all existing currency and bank balances will be redenominated in “New Dollars,” at a conversion rate of 1 new for every 100 old currency units? Would this not simply be another, almost predictable act of defiance toward the American people by the Master Class? And if that happened, do you honestly believe that the Master Class would not have been alerted in advance and allowed to make special preparations for itself ahead of the devaluation? Do you think they intend to go down in the same ship as the people they defy? If such a currency devaluation were announced, what could you do about it? March on Washington? But how would you get there if your money had been wiped out?

Despite what you may hear from State Media, which includes virtually all establishment news organizations, particularly financial ones (e.g., CNBC), America is on the precipice. No bankrupt nation in history has ever defended or preserved the freedoms of its citizens. In fact, it has been the exact opposite: in desperation, bankrupt governments have routinely plundered their citizens’ wealth and imposed totalitarian controls. What will make things different for the United States, the largest debtor nation in all of recorded civilization?

The United States government cannot ever, possibly pay its debts, is pathologically incapable of controlling its spending or curbing its hunger for both domestic and international empire and persistently refuses to tell the American people the truth. If America’s citizens were told the truth and given the benefit of true leadership, as opposed to the guile and dishonesty of an endless array of political liars and hacks, perhaps they could rally and defeat the problems that afflict them. But instead, they are fed by the Master Class a steady diet of narcotic propaganda that deludes, confuses and enervates them. The truth cannot set people free if it is never told, and that is the essence of America’s gathering tragedy.

In a future article, we will detail specific developments you should watch for to chart the course of America’s ominous and potentially deadly national storm. The current, grave situation is already a clear call to action. When the signals become even more urgent, it will be late in the game to take protective action, and possibly too late. Citizens should begin to prepare now not just for financial survival, but for the personal security of themselves and their loved ones should a Category 5 economic and political hurricane rip into the nation, something that becomes more likely every day.

With respect to personal finances, in virtually every national currency devaluation and major political upheaval in the past, gold has represented sanctuary for the affected people. Gold has not just preserved wealth, but personal freedom as well. While governments can devalue fiat currencies, they cannot, by edict, devalue gold. Yes, they can try to manipulate its price, but unless all governments join in the collusion, ultimately the price will return to market. The market for gold is global, and demand exists in all nations and among all peoples. Should the government attempt to confiscate gold, it will be an outright admission that the financial system is collapsing, and the people will know better than to hand over to a corrupt government their only means of survival. The most important point is this: devalued currencies never rise again. Once they are destroyed, they are gone forever, and those whose wealth had once been denominated in them are wiped out. As you have no doubt heard before, not one fiat currency has survived over time, and that is an indisputable fact. More significantly, no fiat currency has ever suffered the abuse that has been inflicted upon the United States dollar, meaning that it is at extreme risk. Gold has been money for 5,000 years. It has not merely survived, it has prevailed over each and every fiat currency collapse throughout history. Given this, the most important financial question a person can ask him- or herself today is: How is my wealth denominated at this time? And given its denomination, is my wealth likely to be safe in current and evolving circumstances?

One thing is certain: as the epic David and Goliath monetary battle unfolds, between the people fighting to defend their hard-earned wealth on one side, and a Master Class that greedily and pathologically wants to plunder them on the other, the price of gold will become extremely volatile for a period of time. Volatility will, in fact, tell you that the War on Wealth has officially been declared, and will be your signal to do whatever you must to protect what is yours. As the government Goliath and its Master Class allies short tonnes of bullion into rigged futures markets in a desperate attempt to make gold look dangerous and risky, the Davids will be coming forth not just in the United States but from all corners of the globe, buying 10 grams here and one ounce there. There are 6.8 billion Davids, versus one diseased Master Class that numbers in the small millions. There is no way the Master Class can defeat the people, if the people finally rise up and say “No More of Your Plunder. No More of Your Cold and Soulless Financial Oppression. No More of Your Cynical and Godless Exploitation.”

If you find the above argument compelling, you should consider how to protect yourself from Executive Orders that could be issued at any time, under any pretext, and that could be extremely hostile to your financial and/or personal health and well being. One simple way to start is to purchase one ounce of gold for yourself and each member of your household, and much more if you can afford it. That is not financial advice; it is merely the common sense generously communicated to you by history.

By Stewart DoughertyStewart Dougherty is a specialist in inferential analysis, the practice of identifying patterns and trends from specific, contemporary events, and then extrapolating their likely effects upon the future. Inferential analysis can be highly predictive. Dougherty was educated at Tufts University (B.A.) and Harvard Business School (M.B.A., and an academic Fellow). He can be reached at: stewartdougherty@cs.com. . He is not affiliated with or compensated by those he references or recommends. The reader has permission to share or post this article as desired, as long as the content remains unchanged and the author is acknowledged.

Subscribe to:

Posts (Atom)